FedNow Debit Payments effectively as debiting Payers' accounts

FedNow Debit Payments effectively as debiting Payers' accounts and recurring Real-Time instant payments, are defined simply as: Irrevocably collected funds in a Payee bank account and usable immediately by the owner of the account. An upfront on-time 'standing approval' using FedNow Debit Payments effectively as debiting Payers' accounts is an instruction or set of instructions a Payer uses to pre-authorize their financial institution to pay future Request for Payments, RfPs without requiring the Payer to review and approve each RfP.

FedNow Debit Payments effectively as debiting Payers' accounts and recurring Real-Time instant payments, are defined simply as: Irrevocably collected funds in a Payee bank account and usable immediately by the owner of the account. An upfront on-time 'standing approval' using FedNow Debit Payments effectively as debiting Payers' accounts is an instruction or set of instructions a Payer uses to pre-authorize their financial institution to pay future Request for Payments, RfPs without requiring the Payer to review and approve each RfP.

Attributes of FedNow Debit Payments

Using FedNow for Debit Payments combined with "Variable Recurring Payments" (VRP) can greatly enhance real-time payment processing by automating flexible, account-to-account debits directly from the payer’s bank account. Here’s how VRP with FedNow can be effectively utilized to facilitate automatic, variable payments while maintaining real-time processing:

1. FedNow Debit Payments for VRP

- Instant Account Debits: FedNow enables instant debiting from the payer's bank account, ensuring that funds are immediately transferred to the payee’s account. This real-time debit is beneficial for businesses needing instant payments, such as subscription services, utilities, or invoicing with flexible payment amounts.

- Direct Bank-to-Bank Transfers: FedNow supports interbank and intra-bank transfers, allowing for seamless, direct transactions between accounts at different banks, which is critical for VRP setup.

- Final and Irrevocable Transactions: Once a FedNow debit transaction is complete, it is final and cannot be reversed, reducing risks of payment disputes.

2. Variable Recurring Payments (VRP)

- Dynamic Payment Amounts: VRP allows flexibility in recurring payments, so the debited amount can vary based on the payer’s usage or billed amount. This is ideal for services with fluctuating monthly fees, such as utilities, pay-as-you-go subscriptions, or telecommunications.

- Automated Debit Triggers: VRP can be set up to trigger automatic debits when certain conditions are met, such as a bill issuance or a payment due date, with the specific amount dynamically calculated based on recent activity.

- Reduced Administrative Overhead: VRP reduces the need for manual intervention in adjusting recurring payment amounts, allowing both businesses and customers to experience streamlined payments with less time spent on administrative tasks.

3. Benefits of FedNow VRP for Businesses and Payers

- Immediate Cash Flow Improvement: Since funds are debited and settled in real-time, businesses benefit from improved cash flow and liquidity. This instant availability enables quicker response times for financial planning, inventory management, and payroll.

- Enhanced Customer Experience: Customers enjoy the flexibility of VRP, as it allows their payments to adjust automatically based on usage, without the need to reauthorize or change fixed amounts.

- Reduced Payment Failures: The immediacy of FedNow's processing and the predictability of VRP make it less likely that payments will fail due to insufficient funds, as customers know the exact amounts and timing of debits.

4. Implementing VRP with FedNow in a Financial System

- API Integration for Automatic Triggers: Integrate VRP with FedNow using APIs that connect directly to a financial institution’s systems. These APIs can dynamically adjust the debit amount and initiate real-time payments automatically based on pre-defined variables like usage, billing cycles, or subscription changes.

- Customer Authentication and Consent: To use VRP, customers must provide explicit consent for variable debits from their accounts, typically via secure digital agreement. This ensures that each debit is authorized and transparent to the payer.

- Automated Notifications: Customers receive automated notifications of each debit, with details about the amount and reason, fostering transparency and trust.

5. Use Cases for FedNow VRP

- Utility and Telecom Payments: Monthly bills for electricity, water, and telecommunications fluctuate based on usage. VRP allows these companies to debit the exact amount owed in real time, without requiring customers to adjust payment settings.

- Subscription Services with Variable Tiers: Streaming, SaaS, or gaming services can adjust monthly charges based on usage or plan changes, with FedNow debiting the payer’s account accordingly.

- Insurance Premiums with Adjustable Rates: Insurance companies can use VRP to adjust premiums based on a customer’s risk profile or claims history, ensuring the correct premium amount is debited in real time.

6. Security and Compliance Considerations

- Data Encryption and Authentication: FedNow and VRP integrations require strong encryption and multi-factor authentication to protect sensitive data and ensure only authorized payments are processed.

- Compliance with Payment Regulations: Ensure VRP setup meets regulatory requirements for recurring payments, particularly around consent and data handling, as well as any applicable FedNow compliance guidelines.

- Customer Consent for VRP Authorization: To activate VRP, customers should give explicit, ongoing consent to enable flexible debits, with clear terms about payment frequency, amount variability, and cancellation options.

Conclusion

FedNow combined with Variable Recurring Payments (VRP) offers a powerful tool for handling flexible and instant debit payments. For businesses, VRP with FedNow means more efficient cash flow, a streamlined payment process, and the flexibility to charge variable amounts based on real-time data. For customers, VRP offers convenience and predictability, aligning with real-time financial demands and creating a positive, hassle-free payment experience.Creation Recurring Request for Payment

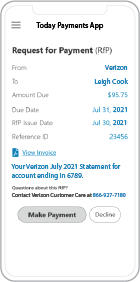

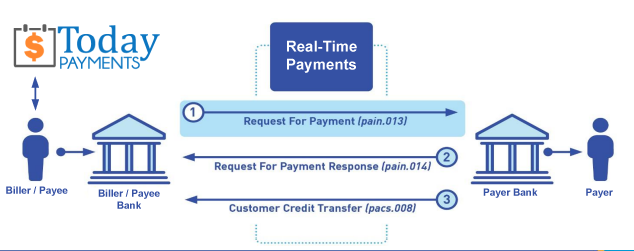

We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-TimePayments.com to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", either FedNow or RTP, will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

ACH and both Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions

The versions that

NACHA recommends for the Request for Payment message and the Response to the Request are pain.013 and pain.014

respectively. Version 5 for the RfP messages, which

The Clearing House Real-Time Payments system has implemented, may also be utilized as

there is no material difference in the schemas. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP ® and FedNow ® versions are Credit Push Payments.

Payees ensure the finality of Instant Real-Time

Payments (IRTP) and FedNow using recurring Requests for

Payments (RfP), Payees can implement certain measures:

1.

Confirmation Mechanism:

Implement a confirmation mechanism to ensure that each

payment request is acknowledged and confirmed by the payer

before the payment is initiated. This can include requiring

the payer to provide explicit consent or authorization for

each recurring payment.

2.

Transaction Monitoring:

Continuously monitor the status of recurring payment

requests and transactions in real-time to detect any

anomalies or discrepancies. Promptly investigate and resolve

any issues that arise to ensure the integrity and finality

of payments.

3.

Authentication and

Authorization: Implement strong

authentication and authorization measures to verify the

identity of the payer and ensure that only authorized

payments are processed. This can include multi-factor

authentication, biometric verification, or secure

tokenization techniques.

4.

Payment Reconciliation:

Regularly reconcile payment transactions to ensure that all

authorized payments have been successfully processed and

finalized. This involves comparing transaction records with

payment requests to identify any discrepancies or

unauthorized transactions.

5.

Secure Communication Channels:

Utilize secure communication channels, such as encrypted

messaging protocols or secure APIs, to transmit payment

requests and transaction data between the payee and the

payer. This helps prevent unauthorized access or

interception of sensitive payment information.

6.

Compliance with Regulatory

Standards: Ensure compliance with

relevant regulatory standards and guidelines governing

instant payments and recurring payment transactions. This

includes adhering to data security requirements, fraud

prevention measures, and consumer protection regulations.

By implementing these measures, Payees can enhance

the finality and security of Instant Real-Time Payments

using recurring Requests for Payments, thereby minimizing

the risk of payment disputes, fraud, or unauthorized

transactions.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing