FedNow Debit Payments effectively as debiting Payers' accounts

FedNow Debit Payments and Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank, B2B, B2C and C2B account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions.

FedNow Debit Payments effectively as debiting Payers' accounts for your business using Real-Time Payments

Implementing Real-Time Debit Payments with Variable Recurring Payments (VRP) via Real-Time Payments (RTP) offers an effective, automated approach to managing dynamic, account-to-account debits. This setup is beneficial for businesses and consumers who require flexible payments based on usage or need instant, secure, and final transactions. Here’s how VRP works within RTP to enable effective, real-time debit payments:

Overview of VRP and Real-Time Payments for Debit Transactions

- Real-Time Payments (RTP) for Debit

Transactions

- Instant, Irrevocable Transfers: RTP ensures that funds are debited and made available in real-time to the recipient, providing instant liquidity and cash flow for businesses.

- Final Transactions: RTP payments are irrevocable, meaning that once a debit is processed, it is final. This provides security for the recipient, reducing risks of chargebacks and returns.

- 24/7/365 Availability: Unlike traditional banking, RTP operates continuously, enabling debits and fund transfers at any time, even on weekends and holidays, ensuring payment flexibility and immediate access to funds.

- Variable Recurring Payments (VRP)

- Dynamic Debit Amounts: VRP allows for recurring payments with variable amounts, which adjust automatically based on pre-defined factors like usage, fees, or service tiers.

- Automated Adjustments: VRP can modify payment amounts without requiring payer intervention, which is ideal for services with fluctuating charges, such as utilities, subscriptions, or metered billing.

- Flexible Payment Timing and Frequency: VRP is customizable to adjust payment schedules, meaning debit transactions can occur based on billing cycles, usage thresholds, or specific triggers.

Benefits of Combining VRP with Real-Time Payments

- Cash Flow Optimization for Businesses

- Immediate Access to Funds: Businesses benefit from immediate liquidity, improving cash flow management and financial planning. For industries with high cash flow needs (e.g., telecom, utilities, insurance), real-time debit payments are transformative.

- Reduced Payment Processing Time: Automated, instant payments reduce time spent on manual reconciliations and processing, enabling a smoother cash flow cycle.

- Improved Customer Experience

- Predictable and Transparent Payments: Customers know that payments will be debited based on real-time usage or agreed-upon criteria. Notifications and confirmations provide clarity on each debit transaction, enhancing trust.

- Eliminates Manual Payment Adjustments: Customers don’t need to change settings or authorize each payment amount, as VRP adjusts automatically, making it convenient for variable expense categories like utilities or flexible subscriptions.

- Enhanced Security and Finality

- Secure and Authorized Transactions: VRP requires payer authorization, ensuring each debit transaction is pre-approved and secure. Since RTP debits are final, payees gain security against potential reversals.

- Compliance with Data Protection Standards: Real-Time Payments and VRP comply with industry regulations, often including two-factor authentication (2FA), encryption, and data protection, safeguarding customer data and transaction integrity.

Setting Up VRP with Real-Time Payments

- Implement API Integration for VRP and

RTP

- Direct Bank Integration: Through APIs, banks can connect VRP to their RTP infrastructure, allowing automatic adjustments and instant debits directly from the payer’s account. This API setup ensures real-time, secure data exchanges and transaction automation.

- Triggers and Automated Amount Adjustments: APIs enable VRP to detect changes in variables (like usage or thresholds) and adjust the payment amount for each debit transaction, ensuring accuracy and flexibility for payees and payers alike.

- Customer Authorization and Consent

- Pre-Authorization for Variable Debits: Customers must authorize VRP, providing consent for variable debits based on pre-defined terms like frequency, maximum debit amount, and triggers for payment adjustments. This can be managed via secure digital forms, ensuring customer protection.

- Notifications for Transparency: Real-Time Payments platforms can send automatic notifications each time a VRP-based debit occurs, detailing the amount, date, and reason, enhancing transparency and customer trust.

- Use Cases for VRP in Real-Time

Payments

- Utility Billing: Monthly utility costs that fluctuate based on consumption can be easily managed with VRP, allowing automatic debits directly tied to the monthly bill amount.

- Subscription Services with Tiered Pricing: Businesses offering pay-as-you-go services, like streaming or cloud storage, can adjust monthly payments dynamically, reflecting each customer’s actual usage.

- Insurance Premiums and Adjusted Risk-Based Payments: Insurance companies can adjust premiums based on claims history, risk profile, or market conditions, using VRP to debit the correct premium in real time.

- Security and Compliance

Considerations

- Data Encryption and Authentication: All RTP transactions require end-to-end encryption and secure authorization, particularly for VRP transactions where variable debits are involved. This ensures transaction integrity and data security.

- Compliance with Payment Regulations: VRP and Real-Time Payments comply with industry standards like NACHA and adhere to guidelines for customer consent, ensuring that variable payments meet regulatory and compliance standards.

Advantages of Using VRP with Real-Time Payments

- Automated Financial Operations: VRP reduces manual intervention, enabling businesses to focus on core activities while automated debits manage payment collection seamlessly.

- Adaptable for Business Growth: As business needs or pricing models evolve, VRP with RTP supports dynamic changes without complex reconfigurations, making it scalable.

- Enhanced Customer Satisfaction: By enabling payment flexibility, transparency, and predictability, customers have an improved experience, with automated, real-time payments that align with actual service usage.

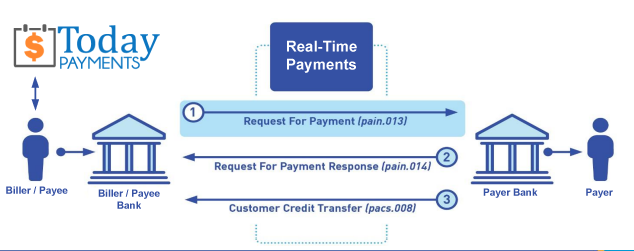

Creation Request for Payment Bank File

Call us, the .csv and or .xml Real-Time Payments (RTP) or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing